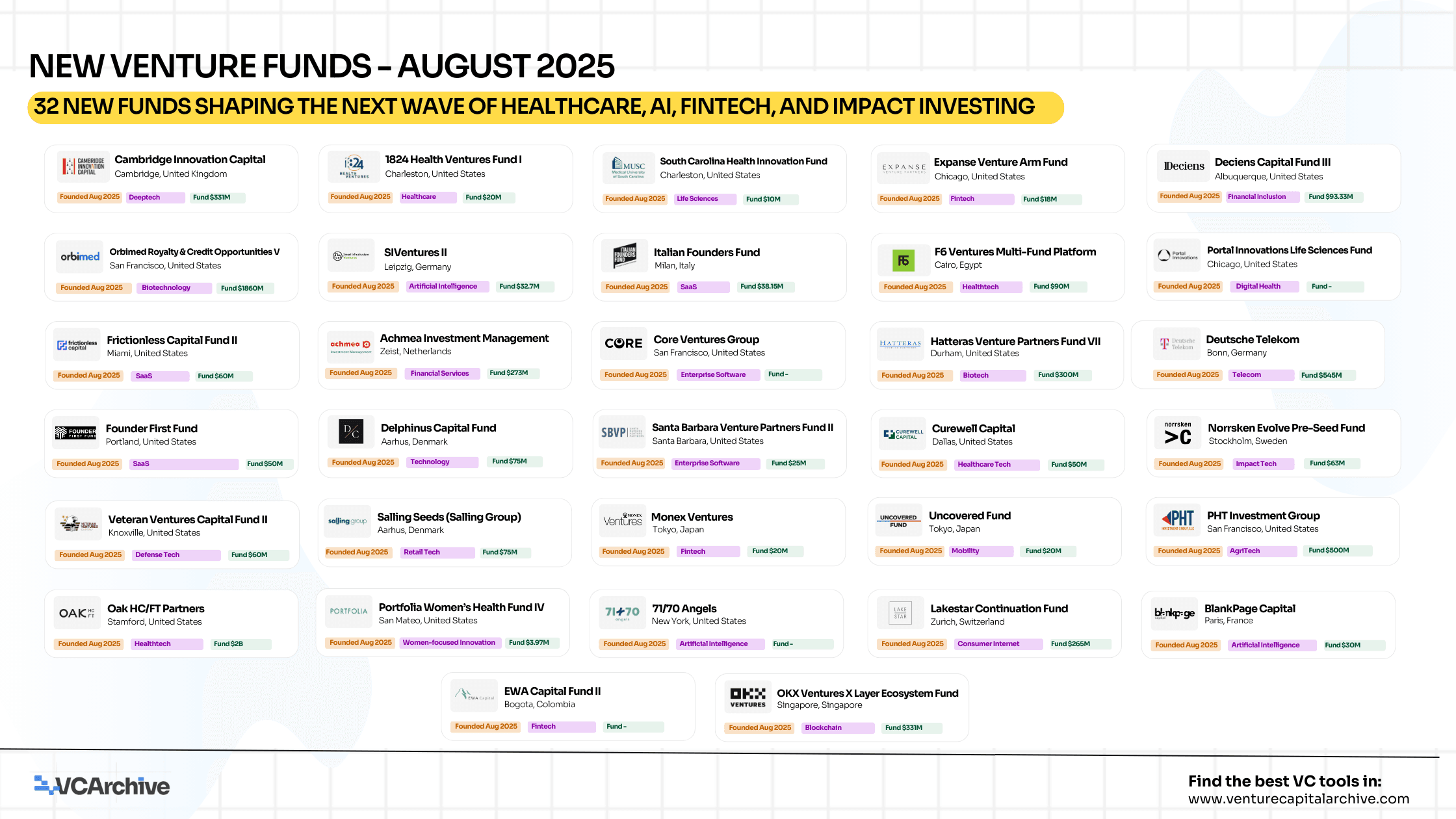

New Venture Funds - August 2025

The funds span a wide range of sectors, from healthcare and life sciences to AI, fintech, and dual-use defense technologies. Notably, this month saw an uptick in ecosystem-anchored vehicles: Cambridge Innovation Capital’s $331M spinout fund linked to the University of Cambridge, MUSC-affiliated 1824 Health Ventures, and South Carolina Health Innovation underscore how research institutions are formalizing lab-to-market pipelines.

Geographically, the United States again leads the count, with activity across Boston, Chicago, Durham, Miami, Dallas, and San Francisco. Europe remained vibrant, with new vehicles out of the UK, Germany, Italy, the Netherlands, Sweden, Denmark, Switzerland, and France. Regional specialization is rising fast: Latin America gained momentum with EWA Capital in Colombia, while Africa saw renewed focus through Japanese investors Monex Ventures and Uncovered Fund, alongside MENA–Africa crossovers like F6 Ventures.

While most funds continue to target Pre-Seed, Seed, and Series A, several heavyweight growth vehicles were also disclosed: OrbiMed Advisors ($1.86B), Deutsche Telekom ($545M), Hatteras Venture Partners ($300M), Achmea Investment Management ($273M), and Lakestar ($265M). Together, they signal that both early experimentation and later-stage scaling remain well capitalized.

The most common sector themes this month include:

- Healthcare & Life Sciences (OrbiMed, Hatteras, Curewell, Portal Innovations)

- AI & Deep Tech (Cambridge Innovation Capital, Smart Infrastructure Ventures, Veteran Ventures)

- Fintech & Inclusion (Deciens Capital, Expanse Venture Partners, Frictionless Capital, EWA Capital)

- Web3 & Tokenized Assets (OKX Ventures)

- Impact & Climate (Norrsken, Salling Seeds, PHT Investment Group)

August’s cohort shows more specialization, more ecosystems, and more scale at the edges: corporates returning with strategic checks, universities formalizing commercialization pathways, and regional funds building repeatable playbooks for regulatory, healthcare, and infrastructure-heavy markets. For founders, that means sharper ICP fit and value-add beyond cash; for LPs, it means clearer theses, defined sourcing channels, and measurable operating leverage.

Explore the full list of New Venture Funds launched in August 2025, including their sector focus, fund size, and global HQ - now live on Venture Capital Archive.

New Venture Funds - August 2025

Rows per page